Note: This transcript has been edited for readability

TRANSCRIPT

Gold Hits All-Time Highs: Assessing the Rally and Gold’s Role in Portfolios

“Gold has always been a diversifier against monetary inflation. What I mean by that is when the quantity of the money supply is being increased and generally the rates are going down, fiat currency is less valuable. Gold is attractive as a storehold of wealth—an alternative place to put your capital. A separate characteristic of gold, which is very diversifying, is it’s truly a global asset. It’s the truest form of geographic diversification in a sense because it belongs to no country. Going forward, geopolitical tensions might simmer down. We all hope they do. But if they don’t, that is a uniquely valuable characteristic.”—Alex Smith, Portfolio Strategist

Jim Haskel

I’m Jim Haskel, editor of the Bridgewater Daily Observations. Gold has been a really interesting asset over the last few months and, really, for that matter, over the last number of years. It has rallied over 30% in the last year alone and, as of this recording, is now right on the cusp of $3,000 an ounce—an all-time record. And the price has jumped over 90% since 2020.

What’s so interesting about the move in gold prices is that the normal relationship between gold prices and real yields has largely broken down, reflective of the fact that the demand for gold is increasingly emanating as a US-dollar alternative for much of the non-US-aligned world. This phenomenon is notable in the aftermath of Russia’s invasion of Ukraine and America’s use of the dollar system to sanction Russia. Now, with the policies that are utilizing tariffs against some of our largest trading partners, questions are rising as to what this will mean for growth, for inflation, and for the monetary system as a whole, and what sort of assets can provide protection against these dynamics in light of the recent equity market sell-off.

This topic has led to a lot of discussion with our clients around where the gold price could go and how to think about gold in their portfolios in terms of their strategic asset mix.

To discuss these issues, I am joined today by Hudson Attar, head of our contra-currency research, and Alex Smith, portfolio strategist. Hudson, Alex, I want to welcome both of you.

Alex Smith

Thanks, Jim.

Hudson Attar

Thanks, Jim.

Chapter 1: Assessing the Shift in Gold Markets Since 2022

Jim Haskel

Hudson, let’s start with you. I’d like to zoom out a little bit, and maybe you could just start by synthesizing how the gold market has changed since Russia’s invasion of Ukraine, because I really think that the shift is key to understanding how to think about gold as an investor today.

Hudson Attar

Great. I think it’s worth briefly just framing that question in terms of the properties of gold and what it looks like to own gold as an investor and, in particular, how it works to own gold relative to how it works to the other things that you could go hold as an investor.

So, the core properties of gold, as I see them, are, first, that it’s not anybody’s liability, and you’re not contingent on anyone else to have access to your savings. Gold is intrinsically valuable rather than somebody’s promise to pay you back, which is different from a bond—obviously, somebody’s promised to pay you back—and different from a stock, where the prospect of value depends on the profitability of the enterprise.

Gold is also supply-limited, meaning the ability to produce more of it is mediated by mining rather than easily printing it at the demand of the government. So, there’s a natural limit on how much of it can be produced at any particular point in time, which protects you against inflation.

And it’s easily transferable and liquid, I would say, meaning if you have ownership of gold, generally speaking, it’s easy to move that claim around through time and space, and also to transact and get back into other things that you’d like to do. If you’d like to draw down your savings to spend whatever—if you’d like to spend down your gold and buy financial assets, the markets are liquid and capable of doing that.

So, those are just the properties of gold, and I think what they give rise to is a behavior for the asset where the thing that you get out of owning it is a surety of access to your wealth and savings, and the knowledge that it’s very unlikely to go all the way to zero. The thing you give up is the compensation that people offer you to own their liabilities. So, holding duration risk for long periods of time—longer-term bonds likely carry a risk premium in them, because governments are paying you to take on that risk of owning their liability. Equities even more so: you’re taking on the risk of things not panning out. With gold, there’s probably not an argument for there being a risk premium. So, that’s sort of what you give up.

I think this opportunity cost for a storehold-of-wealth dynamic is what changed in the gold market in 2022 after Russia invaded Ukraine. That is, coming into that period, the storehold-of-wealth dynamics—of being guaranteed to have access to your wealth and not depending on somebody else to be able to dissave—that wasn’t as salient in the minds of most of the participants in the gold market.

When the West sanctioned Russia’s central bank reserves, it became clear that holding fiat currency savings, you wouldn’t necessarily have access to those savings if you wanted them. It was contingent on the political goodwill that you held with the West and with the US. I think that sparked a re-evaluation of that storehold-of-wealth property and kicked off literally central banks coming into the market in unprecedented size, and then also a big rise in the gold price and a trend that we’ve still been experiencing up until today.

Chapter 2: How Gold’s Performance as an Asset Has Changed

Jim Haskel

Alex, let me bring you in here. Hudson talked about these shifts, and I just want to ask you how these shifts affected the way that gold performs as an asset.

Alex Smith

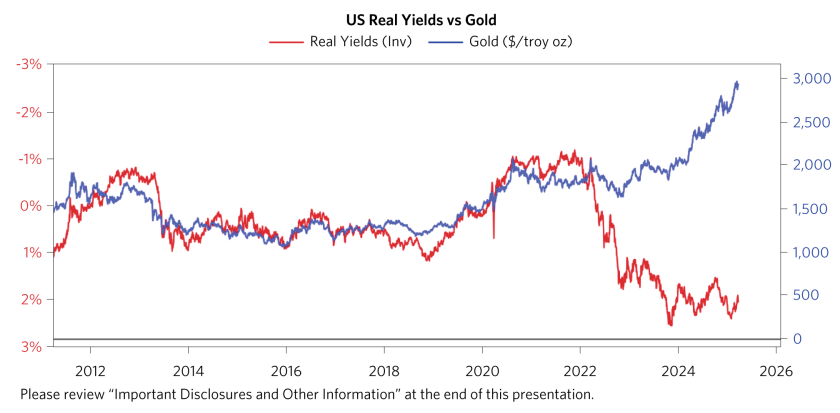

The short answer is that its diversification properties, I think, are even more valuable today. The reason I say that is gold has always been a diversifier against monetary inflation. What I mean by that is when the quantity of the money supply is being increased and generally the rate’s going down, fiat currency is less valuable. Gold is attractive as a storehold of wealth—an alternative place to put your capital. That’s happened before; that happened in the rounds of QE after the financial crisis. You saw the gold price rise, the real yields fell, and there was a very tight relationship there, representing very easy central bank policy and that monetization.

For about a decade, the real yield and gold traded almost tick for tick. What’s different today is that that relationship has completely de-linked.

That highlights a separate characteristic of gold, which is very diversifying, which is it’s truly a global asset. It’s the truest form of geographic diversification in a sense because it belongs to no country. You see that, when that relationship broke down in 2022, it lines up exactly to, as Hudson said, around when the Russian sanctions were instituted.

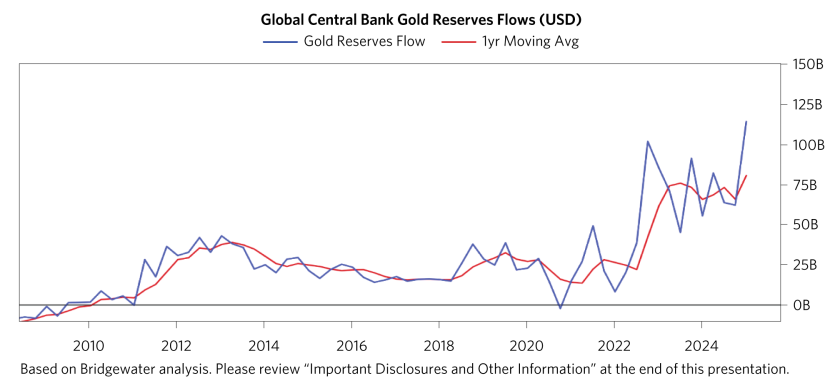

You can see in the player flows, which drive the price, that ramp-up in buying from the East, and there’s a ramp-down in buying from the West.

And so in the West, there was not this seeking of that storehold of wealth. In the East, there was. So, the geographic nature of that became a more dominant feature. Going forward, geopolitical tensions might simmer down. We all hope they do. But if they don’t, that is a uniquely valuable characteristic.

Jim Haskel

Alex, based on what you said, I want to turn to Hudson again. I remember, 2022, the gold price didn’t actually go up that much, but it actually traded in kind of a flat range. And when you consider what was going on at that time—where real yields were rising significantly and bond yields were rising significantly, both in the Treasury inflation-protected market but also in nominal yields—Hudson, it’s kind of amazing that gold didn’t go down a lot during that time.

Hudson Attar

Yes, I think certainly if you had been following the gold market at all in the 10, 15, 20 years preceding 2022, and all you knew was that real yields were up 150 basis points, and somebody posed to you the question of what do you think the gold price did, your answer would be down 15%, 20%, most likely. You’d be looking at what happened in 2013, when we had a huge spike in real yields and the price of gold fell precipitously. You’d be looking at what happened in the inverse in 2008, when real yields fell dramatically and we had a huge rise in the price of gold.

I think the thing that would have made you wrong with that guess in 2022 was that central bankers—who previously, especially in the emerging world, had mostly been buyers in the gold market because real yields were low and the prospective returns of saving in Treasuries, gilts, bunds, and so on and so forth were low—those central bankers got a whole new reason to be in the market, which is that it became risky to not own gold and to own bonds and other places of saving.

So, I think the fact that gold was not down in 2022 points to both the importance of the opportunity cost for gold—that’s the reason it was flat instead of up—and it also points to the truth of there being a big shift in how those public institutions valued holding gold versus fiat currencies.

Alex Smith

Hudson, just to come in and follow up on that, what do you make of the broadening out of purchases that we’ve seen, especially recently, toward an even broader range of countries?

Hudson Attar

The dynamic that’s interesting to watch, and that I think will be critical going forward, is the question of whether these central banks competing with each other cause more and more people who are making reserves allocation decisions to get into the gold market. That is kind of what you saw in peripheral European countries—the Indias and Chinas of the world got in first. Then, over time, you’ve had an emergence of a second round of buyers come in. The EM Europe countries were one set of buyers; Brazil recently reported a gold purchase for the first time, in January, in about five years.

I want to show you a chart of central bank gold reserves flows that I think really highlights this point.

So, I think the question that we have to ask going forward is how far does that original shift in allocation coming out of the Russia/Ukraine dynamic have to go? Then, second, does the move into gold create sort of a cascading effect of “I don’t want to have to wait until it is $3,000 or $3,500 or whatever to get my allocation shift done”?

Chapter 3: What’s Been Driving the Gold Rally

Jim Haskel

Let’s move to what’s been driving the gold market action recently.

Hudson, in my intro to our discussion, I noted the material move in the price of gold. Even this year, gold is up approximately 10%, and already in 2025, we have seen the implementation of tariffs, a lot of physical shortages being reported, and the repatriation of gold back into the United States. So, can you explain what’s been driving the rally and the tumult in the gold market?

Hudson Attar

The most important thing, I think, to know about the gold market now and how it’s been trading in 2025 is that tariffs, I think, are by and large a bullish pressure on gold. There’s a large number, I think, of smaller linkages between tariffs and gold and the way it flows through. But the overriding synthesis is that it’s probably a bullish pressure.

The reasons that it’s bullish are, first, it creates a one-off source of inflation. As Alex was describing, when the value of money falls relative to the value of real assets, that’s a bullish pressure for things like gold that can’t be printed away. Often the thing that counterbalances that bullish pressure on gold is that central banks realize that the currency’s debasing, and they raise the real returns on holding fiat-denominated assets; they raise real rates. But when you have a type of inflation that only hits one time, central banks often look past it. And so, you can get the debasement of the currency without a proportional rise in the opportunity cost of holding gold. I think that tariffs are kind of a perfect storm for that particular type of inflation, where you get the compensation for holding gold, a debasement without having to pay the higher opportunity costs. I think that’s bullish.

I think the rise in uncertainty is bullish too—around trade policy, around international relations. I think people look toward assets like gold in those types of environments for reasons that Alex and I have both touched on. The diversification properties that the asset holds, I think, become more valuable.

So, I think that’s the important forward-looking thing to keep in mind, and that’s one way you can make sense of the resurgence in the rally since Trump’s election and the initial consolidation that happened there in the month after that.

I think with that logged, to talk about the particular dynamics that have happened, backward-looking, I think there’s been, at least in part, a more technical dynamic in the gold market, which is that importers of gold into the US, to some degree, wanted to lock in the prices of gold that they were paying in advance of tariffs. They achieved that by going long gold’s futures, going long gold on COMEX, because it’s a very cheap way to go long gold. You don’t actually have to take delivery of the asset and custody it until you’re going to need the gold eventually later.

So, there was this huge upwelling of demand on COMEX for gold futures, and it was so significant—and this was around a month ago, when Trump started talking about doing tariffs on Canada and Mexico. It was such an upswell of demand in the futures that the futures price in New York diverged from what the futures price ought to have been based on the price of cash gold and the interest rate that you pay to borrow money, use that money to buy gold and store it. Those two things should mostly equate to each other.

And so, what participants in the gold market realized was if the price of gold in the future is 5%, and I can borrow money for 3%, use that borrowed money to buy gold, throw it in a vault in New York, and then deliver that against the future, I can earn 2%, largely risk free. The only risk that I face is the risk of the “arbitrage,” the difference between the futures price and what it ought to be moving further against me in the interim.

So I think, to some degree at least, a reason that the physical gold all came to New York was that bullion banks and commercial banks realized the opportunity to do this arbitrage. They got as much gold as they could from the BoE vault and from Switzerland. They shifted it to COMEX vaults, put it in the vault, shorted the future, and tried to collect that time spread.

So, the whole story I think there is, the desire to get ahead of tariffs by importers, resulting in an opportunity to collect a futures-versus-cash arbitrage that required physical gold to come in and sit in the warehouse in order to back the shorts that these banks were doing in the futures contracts.

Chapter 4: Addressing Some Hot Topics in the Gold Market

Jim Haskel

I think it’s worth addressing some of the hot topics coming out of the gold market recently. So, for example, there’s been a number of headlines around whether the US will revalue the Treasury’s gold, and President Trump has talked about auditing the gold in Fort Knox. Can you explain what investors should make of these stories?

Hudson Attar

It’s hard, really, to know what’s going on in the gold market, and it’s notoriously opaque. So I do want to make that clear, that the things I’m saying are, to some degree, speculative.

With that said, just to kind of describe my thinking on the questions that you’re raising, I think the first, and one of the more commonly discussed areas of interest in gold, has been this question of whether the Treasury is going to revalue the gold that it holds on its balance sheet as assets.

Jim Haskel

It’s marked at about $42 an ounce. And meanwhile, the price is fluctuating between $2,900 and $3,000. So what would be the effect of marking that to market?

Hudson Attar

The gold market, the price of gold, is, at the end of the day, every day, determined by the amount of buyers and the amount of sellers, and how that thing clears. For a revaluation to matter to the market price of gold that you face and that I face, I think it has to create a flow. Somebody has to either want to sell gold or somebody new has to want to come in and buy gold because of the revaluation. From where I sit, at least, I can’t really see a direct connection between the Treasury revaluing the gold that it holds on the balance sheet and any direct sort of buying pressure in the market that you and I face.

So I don’t see a super direct connection there. I could be missing something, but that’s sort of my understanding of the mechanics—that it would largely be an accounting change, rather than a change in the flows in the market for gold. So I wouldn’t expect to see much pressure if the Treasury were to revalue its gold assets.

Alex Smith

The only way you could get a flow is if you were to repo the gold or something like that and issue more Treasury bills. But I think Secretary Bessent was on Bloomberg and effectively denied this—doesn’t mean it won’t happen, but he said “that’s not what I had in mind” when they asked him directly on this. So, I wouldn’t see the flow either.

Hudson Attar

I think, on Fort Knox, my understanding is that, in general, when you’re custodying gold, the standard operating procedure is to minimize the amount of information that you give to the public, because it creates vulnerability and it impinges privacy. So if you asked the operators at the New York Fed, if you asked the operators of the BoE, I think they would all tell you that that’s sort of their base policy—to minimize public diffusion of information about how they store the gold, where exactly the gold is, the nature of the vault, and so on and so forth.

So that’s my understanding of the reason why the level of transparency around Fort Knox is what it is. The Mint, I believe, audits the gold and assays the gold yearly. The details of those audits aren’t public for that reason of wanting to limit information.

So the most important thing, I think, is that there’s no positive evidence of any gold being missing or less pure than it’s supposed to be in Fort Knox. There’s just the question—I think the question is only possible because there’s that desire to limit information to protect security and privacy.

Chapter 5: The Role of Gold in Portfolios

Jim Haskel

All right, Alex, let’s zoom back out. If you consider all of the different dynamics we’ve discussed today, how should investors be thinking about gold as part of their portfolios? At Bridgewater, one approximation we’ve thrown around over the years is that a roughly 10% allocation to gold would help diversify a portfolio, given its negative correlation to financial assets.

Now, when you’re advising clients on diversification today, and their gold allocation in particular, is that same 10% a reasonable recommendation range for most portfolios?

Alex Smith

Our clients are very sophisticated in their allocation; they do a robust assessment based on the characteristics. But we definitely think that having an allocation to diversified assets—and gold has unique diversification characteristics—makes sense along the lines of something in the range that you said.

The reason for that isn’t that they’re a return generator—we think the risk premium or expected return above cash is probably zero. There’s not a logical transfer of risk one way or the other. But even with that, we assess that it would be very valuable in a portfolio.

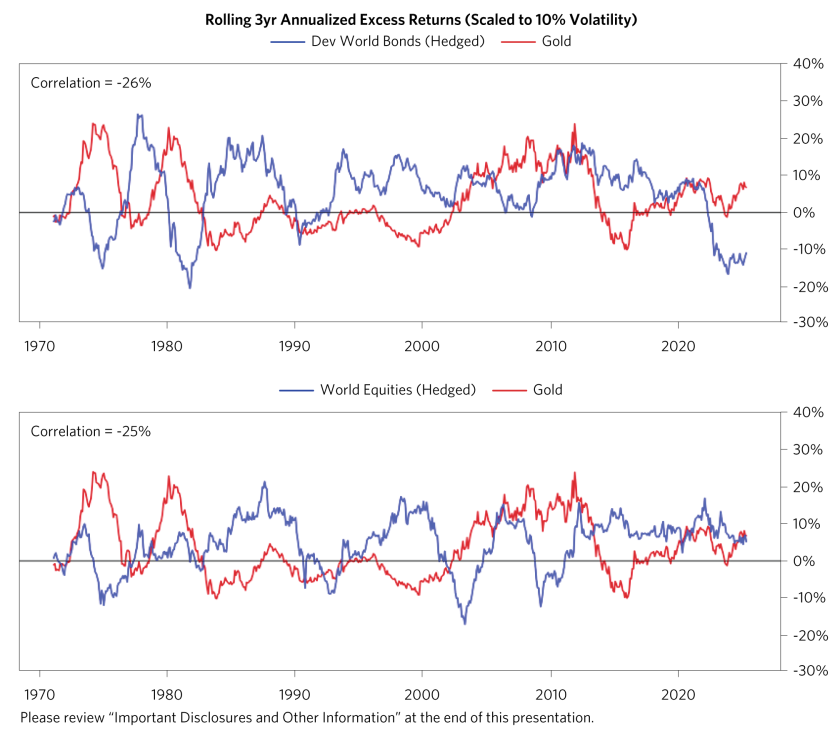

And so, quantitatively, you could think about that as it’s negatively correlated. Over longer periods, like three- and five-year periods, it’s something like -30% correlated to financial assets, which is, of course, just an outcome of the diversification properties that we talked about.

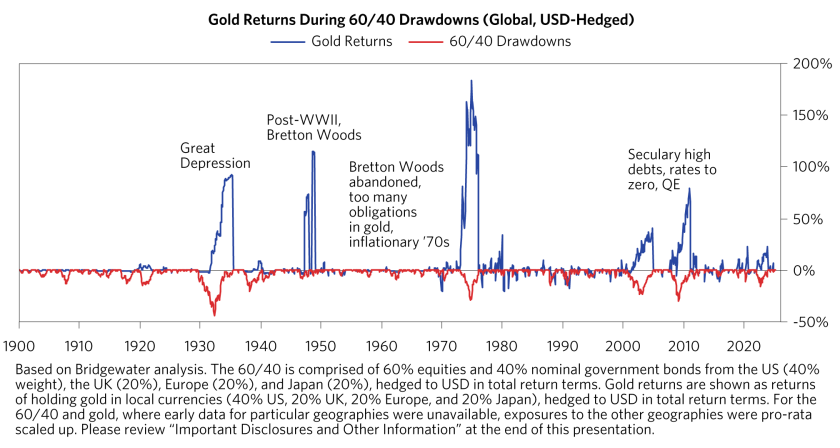

And another characteristic is that when your portfolio is in drawdown, gold tends to perform very, very well in those circumstances.

Jim Haskel

By the way, we wanted to put up a chart to really just show that.

This chart goes all the way back to 1900 and it’s not perfect, but you can see that the blue line is the gold price and the red line is the returns of a 60/40 portfolio when it’s in drawdown, meaning losing money. You can see, really, the inverse correlation of that sometimes.

Alex Smith

Yes, and I think that when you show this chart, it’s a really compelling chart. And you can imagine the worlds that gold does well in are often the worlds that are bad for your portfolio.

Chapter 6: Why Gold Is So Diversifying

Jim Haskel

Can you just walk through this a bit more? Why is gold so diversifying when traditional portfolios tend to underperform?

Alex Smith

You get the benefit of generally doing well when you either have a combination of rising inflation or falling growth, and it depends on the flavor of what you’re getting. But if you just think about on a relative basis compared to other assets, if the economy’s producing lots of cash flows that can be earned, especially on an inflation-adjusted basis through owning stocks and bonds, that’s generally a good economy, and that’s generally a bad time for gold because it’s competing with those income-producing assets.

When you have an economy that’s not producing those types of real returns, then gold becomes much, much more attractive. That can tend to occur in recessionary environments. That also tends to be when bond yields fall. It can also occur in more stagflationary environments over a longer period of time. Geopolitical shocks are another kind of unique case of that.

Then the flip side, again, is the case where it underperforms. It’s kind of the reverse—the case where you have low inflation, solid growth, good returns to investors tends to be a poorer period for gold, and you do see this. There are allocators that I’ve certainly spoken to who felt burned when they bought gold in 2012 and then you had the real yield move that Hudson talked about and gold fell. But that’s a diversifier. When an asset loses money at the time that you expect it to lose money for the reasons you expect and your broader portfolio does well, that all works well from a portfolio construction perspective. But you want to understand those characteristics and know what to expect very clearly, so that if and when gold performs to the upside or downside, you can have a very clear way to explain that to your stakeholders.

The general pushback is, “Well, how could I allocate 5%, 10%, or 2%?” I mean, a lot of people are at zero, Jim. How could I allocate my portfolio to an unproductive asset when I have to earn 7%, 7.5%?

There are a couple of things to say to that. One is gold is an inherently quite volatile asset, and it’s a volatility that you want because it cancels out some of your other volatility. So you can move the needle with a relatively small capital allocation.

The second piece is that you can use portfolio engineering to structure gold as an overlay. For example, holding gold futures, or you hold the gold and you get leverage elsewhere in the portfolio. So, those are all ways that you can monetize that better risk-adjusted return into a higher return.

And so when we look going forward—to be clear, I don’t want people to get the wrong idea; gold could easily go down from here, there’s a wide range of outcomes for it—but at a time when many investors have zero, having some allocation is likely valuable given the specific environments that gold can outperform.

Jim Haskel

These charts that I’m now showing you here show the relationship.

This is another way to break down the 60/40 relationship to gold, but this shows the rolling three-year-annualized returns.

When you look at the top chart, which is developed world bonds hedged against gold, you can see there’s a pretty good, diversified relationship there. It’s actually, like, -26% correlated. Then when you look at world equities hedged against gold, that’s -25%. So really good, diversifying properties.

Alex Smith

You’re not going to find another asset like that. There’s no asset that you can go buy and hold with correlations that work that way for reasons that you would expect. It’s very, very rare to find, and therefore, it’s very valuable.

Jim Haskel

Alex, you mentioned earlier that, theoretically, investors shouldn’t expect gold to offer them a positive return over cash through time. You could make the argument that it should actually have a negative return, because I think you should have to pay for the privilege of having an asset that cannot default on you. But in practice, the opposite has actually been true. Gold has returned positively relative to cash.

So here are my questions: how much does an investor really need to lean on the belief that gold will be diversifying to justify holding it? If gold is so diversifying, isn’t this already reflected in the gold price? And lastly, can you imagine a type of investor for whom an allocation of gold just makes no sense?

Alex Smith

I think you do need to heavily believe in the diversification properties. Absolutely, it hinges on that. And I think there’s very good logic for that that we discussed.

And then, in terms of why isn’t that priced in, I think diversification is a very hard thing for investors price in. The theory says it should be priced in, but the way that so many investors are evaluated, as well as the way that I think a lot of investor psychology works but especially the stakeholder valuation, is very much on return, not in diversification. So it actually, to me, makes sense that diversification isn’t priced in. And today, gold being somewhat perilously high, I think it’s more a reflection of the price has gone up and people like that than they see it as a strategic diversifier, well, at least in a broad-based way. There’s probably a mix of views on that.

Then when you think about investors, when you hold it, there are plenty of investors where it’s not going to work. If you have absolutely no ability to take on leverage and you have a high return target, it’ll improve your ratio but in a way that you can’t monetize to meet your return target.

Now, there might be other ways you could do that. For example, we put out an Observations that, point in time, given the valuation, gold miners are companies that have embedded in them a gold exposure, and then there’s a business on top of that. Basically, the business is exceptionally cheap when you look through the gold exposure. So that could be a way to get exposure in a way that could get you a return that is within your investment guidelines.

If you think in a totally unconstrained way, like, let’s just say someone said, “OK, no, I’m totally unconstrained, but I really think it’s going to be a zero.” Would I hold any of it? The portfolio math would lead you to hold a little bit for something that’s negatively 30% correlated, especially in a more medium-term correlation—that’s even more valuable in some ways in terms of capital preservation.

So, those are the questions you would work through, but you very much could land on, “This isn’t the diversifier I need.” And certainly, we wouldn’t want it to be the only diversifier that you’re relying on in a portfolio.

Chapter 7: The Forward-Looking Picture for Gold

Jim Haskel

Hudson, I’m going to give you the last word in the podcast, so long as you promise to come back. Alex, you, too. Where do you see gold going? What’s the forward-looking picture for gold as best you can assess?

Hudson Attar

If you did not know what the price of gold was today and you only knew the state of the world and the pressures on gold, the picture would, I think, by and large, be quite bullish. You have the combination of tariffs, which I think are bullish for the reasons that I laid out, namely that they create one-off inflation and they increase uncertainty and gyrations in trade and international relations. You have other characteristics of the emerging global order and the Trump presidency, and questions around how predictable he’s going to be for US allies and for general political alignment between nations. You have incredibly high levels of debt across the public sector in the developed world. I think that that trifecta of things is bullish for assets that stand “contra”—stand against the financial assets that one can save in that pay you fiat.

I think there are, at the same time, some real bearish pressures too. So I think you have to decide how seriously you take this. But the sort of push toward increasing fiscal discipline in the West, in the US, I think is a bearish directional pressure on gold. It’s not clear how much they’ll be able to do, but I think if we had a big increase in fiscal discipline in the US, a big reduction in the deficit, that would be bearish for gold.

I think, most importantly, you have the fact that a lot of the reasons that gold is attractive now are consensus—are well-known and well-understood—and are motivating big positions by speculative, faster players in the market. And those players already being in kind of makes this, I think, a less clear bullish scenario for gold than what we had, say, earlier on in 2022, when the world was just shifting and people didn’t have the trend to point to.

So when I add it all up, I think, at the end of the day, what we are talking about with gold is a market where the actual throughput of metal to end demand is quite low in size relative to the balance sheets of the players that need to get in or out of the market. That’s why gold has these massive 10-, 20-year shifts in price regimes—because it takes a long time for these shifts and pressures to get reflected in what people actually hold because of the throughput of the market relative to the assets and liabilities of the players that need to transact.

So I think that, most likely, the pressures will continue to support the gold price for at least the near term. But the cone of uncertainty is why I think that it’s easy to imagine cases where either we’re further along in the story of the shift than I expect, or the degree of consensus on that trade is higher than I expect.

Jim Haskel

With that, let’s bring this to a close. Alex Smith and Hudson Attar, thank you so much for your time.

Alex Smith

Thanks, Jim.

Hudson Attar

Thanks, Jim.

Important Disclosures and Other Information

This research paper is prepared by and is the property of Bridgewater Associates, LP and is circulated for informational and educational purposes only. There is no consideration given to the specific investment needs, objectives, or tolerances of any of the recipients. Additionally, Bridgewater's actual investment positions may, and often will, vary from its conclusions discussed herein based on any number of factors, such as client investment restrictions, portfolio rebalancing and transactions costs, among others. Recipients should consult their own advisors, including tax advisors, before making any investment decision. This material is for informational and educational purposes only and is not an offer to sell or the solicitation of an offer to buy the securities or other instruments mentioned. Any such offering will be made pursuant to a definitive offering memorandum. This material does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual investors which are necessary considerations before making any investment decision. Investors should consider whether any advice or recommendation in this research is suitable for their particular circumstances and, where appropriate, seek professional advice, including legal, tax, accounting, investment, or other advice. No discussion with respect to specific companies should be considered a recommendation to purchase or sell any particular investment. The companies discussed should not be taken to represent holdings in any Bridgewater strategy. It should not be assumed that any of the companies discussed were or will be profitable, or that recommendations made in the future will be profitable.

The information provided herein is not intended to provide a sufficient basis on which to make an investment decision and investment decisions should not be based on simulated, hypothetical, or illustrative information that have inherent limitations. Unlike an actual performance record simulated or hypothetical results do not represent actual trading or the actual costs of management and may have under or overcompensated for the impact of certain market risk factors. Bridgewater makes no representation that any account will or is likely to achieve returns similar to those shown. The price and value of the investments referred to in this research and the income therefrom may fluctuate. Every investment involves risk and in volatile or uncertain market conditions, significant variations in the value or return on that investment may occur. Investments in hedge funds are complex, speculative and carry a high degree of risk, including the risk of a complete loss of an investor’s entire investment. Past performance is not a guide to future performance, future returns are not guaranteed, and a complete loss of original capital may occur. Certain transactions, including those involving leverage, futures, options, and other derivatives, give rise to substantial risk and are not suitable for all investors. Fluctuations in exchange rates could have material adverse effects on the value or price of, or income derived from, certain investments.

Bridgewater research utilizes data and information from public, private, and internal sources, including data from actual Bridgewater trades. Sources include Absolute Strategy Research, BCA, Bloomberg Finance L.P., Bond Radar, Candeal, CEIC Data Company Ltd., Ceras Analytics, China Bull Research, Clarus Financial Technology, CLS Processing Solutions, Conference Board of Canada, Consensus Economics Inc., DTCC Data Repository, Ecoanalitica, Empirical Research Partners, Energy Aspects Corp, Entis (Axioma Qontigo Simcorp), Enverus, EPFR Global, Eurasia Group, Evercore ISI, FactSet Research Systems, Fastmarkets Global Limited, The Financial Times Limited, Finaeon, Inc., FINRA, GaveKal Research Ltd., GlobalSource Partners, Gordon Haskett Research Associates, Harvard Business Review, Haver Analytics, Inc., Institutional Shareholder Services (ISS), Insync Analytics, The Investment Funds Institute of Canada, ICE Derived Data (UK), Investment Company Institute, International Institute of Finance, JP Morgan, JSTA Advisors, LSEG Data and Analytics, MarketAxess, Medley Global Advisors, Metals Focus Ltd, MSCI, Inc., National Bureau of Economic Research, Neudata, Organisation for Economic Cooperation and Development, Pensions & Investments Research Center, Pitchbook, Political Alpha, Renaissance Capital Research, Rhodium Group, RP Data, Rubinson Research, Rystad Energy, S&P Global Market Intelligence, Sentix GmbH, SGH Macro, Shanghai Metals Market, Smart Insider Ltd., Sustainalytics, Swaps Monitor, Tradeweb, United Nations, US Department of Commerce, Visible Alpha, Wells Bay, Wind Financial Information LLC, With Intelligence, Wood Mackenzie Limited, World Bureau of Metal Statistics, World Economic Forum, YieldBook. While we consider information from external sources to be reliable, we do not assume responsibility for its accuracy. Data leveraged from third-party providers, related to financial and non-financial characteristics, may not be accurate or complete. The data and factors that Bridgewater considers within its research process may change over time.

This information is not directed at or intended for distribution to or use by any person or entity located in any jurisdiction where such distribution, publication, availability, or use would be contrary to applicable law or regulation, or which would subject Bridgewater to any registration or licensing requirements within such jurisdiction. No part of this material may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without the prior written consent of Bridgewater® Associates, LP.

The views expressed herein are solely those of Bridgewater as of the date of this report and are subject to change without notice. Bridgewater may have a significant financial interest in one or more of the positions and/or securities or derivatives discussed. Those responsible for preparing this report receive compensation based upon various factors, including, among other things, the quality of their work and firm revenues.