Exploring the different ways institutions are gaining exposure to cryptocurrencies and how these exposures are likely to play out over time.

While cryptocurrencies have been in a drawdown of late, these declines are coming after huge rallies; Bitcoin and Ether remain 4 times and 10 times respectively more valuable than they were just 18 months ago. These run-ups took place during a time of unprecedented liquidity, as trillions of dollars of central banks’ money printing made its way to households via fiscal policies. Over this period, the liquidity of cryptocurrencies significantly increased as many new players entered the markets, and new exchanges, instruments, and service providers to support digital asset investing have continued to mature. Although these remain small markets relative to the most liquid markets in the world, we believe crypto markets are now large enough to allow for positions in sizes relevant to institutional investors.

Looking ahead, we are following how flows into cryptocurrencies evolve in an environment of much less liquidity (and even real tightening). While any asset will have its ups and downs, we are closely tracking whether institutional investors begin to adopt the asset class into their portfolios. At a high level, we see institutional investors as still being at the very early stages of developing exposures, but adoption looks likely to pick up in the coming years. The pace of adoption so far has been rapid, especially in smaller institutions (e.g., family offices), such that it bears watching closely. We see institutional investors beginning to access these markets in a few distinct ways for different purposes:

- Outright exposure to cryptocurrencies: This is the most relevant to watch, since it could grow significantly in size and impact the overall risk and asset allocation of large institutions. The most liquid and common cryptocurrency for outright direct exposure is Bitcoin, which is a potential “digital gold” asset. There is also growing interest and liquidity in Ethereum, a blockchain-based computing platform, whose native currency, Ether, is required as “fuel” to power the decentralized apps on its network—akin to a “digital oil.” Exposure by smaller institutions (e.g., family offices) has grown rapidly. For the largest institutional investors, exposure is much lower but rising, with adoption still held back in part by significant operational and regulatory concerns.

- Exposure to arbitrage and money-making opportunities: The size of potential opportunities in any pool of liquidity can be measured by how often it trades and how high its volatility is. The crypto ecosystem has quickly emerged as a sizable pool of liquidity from this perspective, so we are seeing players step in to trade it. In turn, it is slowly becoming a part of institutional investors’ alpha risk budget as they begin to gain access to these opportunities through their holdings of hedge funds expanding into this area as well as some new crypto-specific funds.

- Exposure to technological growth via venture capital or equities: A large number of new businesses utilizing blockchain tech are being formed, and institutional investors are increasingly investing in them through venture capital or the few listed public equities in the space. This is generally an easy way to gain exposure, as it fits neatly into existing investment mandates and competencies. That said, venture and a few specific public equity names can only be a relatively small part of large institutions’ asset allocations.

Below, we size each of these activities. We begin with our assessment of the size of the market.

Size of the Market and Paths to Exposure

Below, we give a rough sense of the allocation share that Bitcoin and Ether could have in a liquid institutional portfolio relative to other assets. In assessing liquidity, we take into account market cap, trading activity, and other relevant characteristics. We have normalized each market relative to US equities, the single most liquid and accessible market in the world. Cryptocurrencies are still far from being huge markets, but Bitcoin and Ether are now large and liquid enough that institutional investors could access them in relevant size. For example, we think that Bitcoin is about 1.4% as liquid as US equities; this would entail holding a much smaller capital position in the liquid mix, but its high volatility means that a relatively small allocation in dollar terms would still give meaningful exposure on a risk-adjusted basis. As a result, our rough estimate would be that an institutional investor could build a liquid cryptocurrency allocation that is comparable in risk exposure to gold or inflation-linked bonds.

However, cryptocurrencies are still operationally difficult for large institutional investors to access. Holding cryptocurrencies outright requires the development of new operational pathways and approvals for institutional investors. Spot bitcoin (and related derivatives) traded via crypto exchanges or over-the-counter (OTC) with specialist brokers are the most liquid instruments. However, these come with risks around custody and newer counterparties and require setup of new operational and execution capabilities. In contrast, futures-based ETFs and Bitcoin CME futures are available through existing institutional pathways but represent a small share of the total liquidity. The CME futures also often trade at a premium to spot and have an associated basis risk (that has often ranged well above 10% annualized). As a publicly traded security, the Grayscale Bitcoin Trust is an easily accessible and well-regulated product. However, it is a closed-end fund that is not redeemable for actual bitcoin, creating material basis risk, and it is currently trading at a sizable discount to NAV. It also charges 2% annual management fees, high for a passive product. There are also other similar fund products that passively track Bitcoin, Ether, or a broader basket of crypto, but these all involve meaningful fees and/or have limited liquidity. As such, unless the SEC approves a spot bitcoin ETF, accessibility for large institutional investors will remain constrained by the development of custody and counterparty services.

Our Rough Assessment of the Size of Direct Exposure by Institutional Investors

On net, we estimate that ~1 million bitcoin (around 5% of total issued supply, ~$42 billion by current prices) are now held by institutional-level players via custodial intermediaries. CME Bitcoin futures, which have ranged between ~$1-5 billion outstanding over the past year, are small in comparison. This includes both larger institutions and smaller institutions such as family offices, as well as some particularly high-net-worth individuals. Custodial intermediaries are a popular option for such players, as it removes the technological, security, and infrastructure hurdles associated with cryptocurrencies and allows them to have exposure to the asset directly without relying on structured products, which have fees, or actively managing an outright position through futures.

Going Forward, Direct Allocations by Institutions Are Likely to Rise

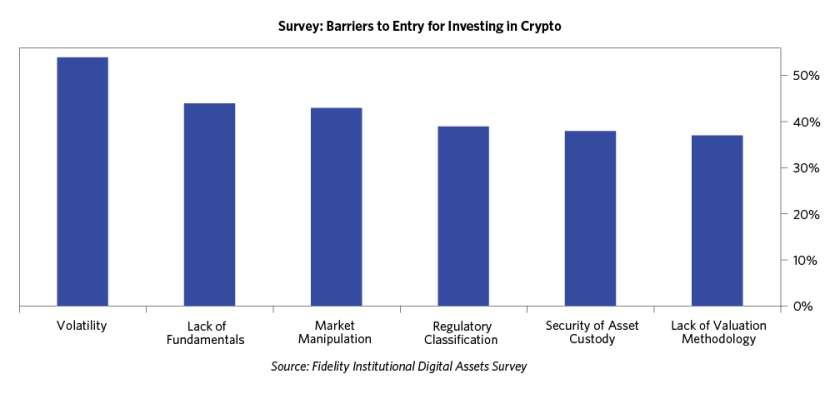

There has been a meaningful uptick in interest toward gaining some exposure to Bitcoin and crypto over the past year or so, across all levels of institutional investors. When we look at what is holding institutions back, some of the barriers cited in surveys are about the nature of the asset class (e.g., it is volatile, hard to value, etc.), and others are more structural (e.g., custody issues and regulatory uncertainty). However, the surveys also indicate that a majority of respondents are interested in digital assets, with nearly 8 in 10 institutions surveyed by Fidelity responding that crypto and digital assets “have a place in a portfolio.” We see outright exposures to crypto from large allocators as likely to grow over time, as institutional-quality investment products and service providers continue to develop at a fast pace and more investors and their stakeholders continue along their processes of exploring the asset class. The investment by many of the major Wall Street banks over the last year in building out new trading desks and infrastructure for Bitcoin and crypto is another indication of expectations that institutional adoption of crypto will grow over the longer term.

At the tip of the spear, a growing and meaningful share of less-constrained institutional investors, such as family offices, have already begun to allocate a small portion of their assets to outright crypto exposure. As shown below, well over half of high-net-worth investors in Europe and Asia have access to digital assets, directly or through financial advisors. The number is lower in the US but still sizable. Additionally, about half of US family offices and about 30% of family offices in Europe and Asia already hold digital assets.

The Growth in Crypto Arbitrage and Money-Making Opportunities for Institutional Investors

The size of potential opportunities in any pool of liquidity can be measured by how often it trades and how high its volatility is. As shown above, the crypto ecosystem has quickly emerged as a sizable pool of liquidity from this perspective, so we are seeing players step in to trade it.

Traditional hedge funds have started to tiptoe into the space as opportunities have grown. According to PWC’s survey for 2020, 21% of traditional hedge fund respondents had some allocation to crypto (~3% of AUM on average), with most intending to deploy more capital at some point in the future. A Fidelity survey similarly found that about 15% of traditional hedge funds now have a crypto allocation. The types of hedge funds that have made crypto allocations are mostly either quantitative/high-frequency trading (HFT) funds or long-short equity funds.

For quant/HFT funds, the opportunity is to extend their existing market-making and statistical arbitrage processes into markets that now have meaningful volumes but remain much more inefficient and offer much higher spreads than traditional assets. For long-short equity funds, their engagement in Bitcoin and crypto has also often been via an extension of strategies such as factor-based investing, tail-risk hedging/asymmetric bets, or stock-picking.

One strategy that is currently popular among hedge funds is the market-neutral “cash and carry” trade. As noted above, Bitcoin CME futures frequently trade at a sizable premium to spot, driven by the lack of dollar funding within the crypto markets relative to demand by speculators for additional leverage. Buying spot bitcoin and selling CME futures has collected an ~10% annualized return since mid-2019 (the start of the recent crypto bull cycle). The charts below show the premiums over time and the size of the short positions by hedge funds that are likely engaging in this trade.

Up until early 2021, a similar trade was available through the Grayscale Bitcoin Trust (GBTC), enabled by the idiosyncrasies of the product. GBTC shares had been trading at a persistent premium to NAV for many years, but accredited investors could subscribe in primary placements for new GBTC shares issued at NAV, with a six-month lockup before secondary market sales were enabled. Hedge funds engaging in this strategy would borrow bitcoin to exchange for GBTC, then sell those GBTC shares for a 10-20% premium to spot bitcoin price after six months, pocketing the difference. However, this opportunity has unraveled since 2021, as the supply of GBTC grew rapidly from funds crowding in, while retail demand for GBTC shares on the secondary market faded due to competition from other Bitcoin products and instruments.

Crypto-specific hedge funds are also starting to emerge, specializing in strategies primarily intended to access crypto assets directly on native platforms and, in some cases, bridge inefficiencies between crypto-linked assets in traditional finance and their corresponding on-chain products. As shown below, estimates of total AUM remain relatively modest, at about ~$20 billion. Many of the largest crypto-native active managers have both hedge fund and VC arms, which can often entail both overlaps and some synergies but makes it difficult to cleanly attribute AUM. Some of the largest crypto funds are also now effectively “prop shops” that do not accept outside capital.

Crypto hedge funds, which specialize in digital assets generally, come in one of two flavors—those that focus on higher-risk directional strategies and those that favor more market-neutral strategies, such as high-frequency trading, market-making, and arbitrage. There are also an increasing number of funds focusing on strategies that are more niche or idiosyncratic to crypto, such as “farming” yield across decentralized finance protocols (DeFi) or trading non-fungible tokens (NFTs). Crypto hedge funds can, by design, move quickly to take advantage of new alpha opportunities in the space as they arise, though the custodial and compliance risks entailed in doing so are unlikely to be acceptable for larger institutions.

Indirect Exposure via Venture Capital or Public Equities

Many entrepreneurs are betting that blockchain technologies will become a backbone of much of the global economy over time and are building businesses using these technologies. These range from new crypto asset exchanges to DeFi protocols that are seeking to rebuild traditional finance functionality in these new technologies to many other industries being reimagined (e.g., digital art, gaming, social networks, sharing-economy platforms). For institutional investors, investing in these companies provides exposure to the potential of distributed ledger technologies—or indirect exposure to the cryptocurrencies themselves in some cases. Exposure is small relative to their large balance sheets but easy to do, as they often already have buckets carved out for VC, and a few large IPOs in the last year or so created public equities that can provide exposure. As shown below, venture funding for cryptocurrency and blockchain companies more than quadrupled to over $25 billion in 2021, and a number of high-profile IPOs in the space monetized large gains for early investors and created public equity exposure opportunities. Crypto exchanges are a particularly popular growth investment for institutions, and we’ve seen several large investors take stakes in FTX, Gemini, and of course the publicly listed Coinbase.

This research paper is prepared by and is the property of Bridgewater Associates, LP and is circulated for informational and educational purposes only. There is no consideration given to the specific investment needs, objectives or tolerances of any of the recipients. Additionally, Bridgewater's actual investment positions may, and often will, vary from its conclusions discussed herein based on any number of factors, such as client investment restrictions, portfolio rebalancing and transactions costs, among others. Recipients should consult their own advisors, including tax advisors, before making any investment decision. This report is not an offer to sell or the solicitation of an offer to buy the securities or other instruments mentioned.

Bridgewater research utilizes data and information from public, private and internal sources, including data from actual Bridgewater trades. Sources include, the Australian Bureau of Statistics, Bloomberg Finance L.P., Capital Economics, CBRE, Inc., CEIC Data Company Ltd., Clarus Financial Technology, Conference Board of Canada, Consensus Economics Inc., Corelogic, Inc., CoStar Realty Information, Inc., CreditSights, Inc., Credit Market Analysis Ltd., Dealogic LLC, DTCC Data Repository (U.S.), LLC, Ecoanalitica, Energy Aspects, EPFR Global, Eurasia Group Ltd., European Money Markets Institute – EMMI, Evercore, Factset Research Systems, Inc., The Financial Times Limited, GaveKal Research Ltd., Global Financial Data, Inc., Harvard Business Review, Haver Analytics, Inc., The Investment Funds Institute of Canada, ICE Data Derivatives UK Limited, IHS Markit, Impact-Cubed, Institutional Shareholder Services, Informa (EPFR), Investment Company Institute, International Energy Agency (IEA), Investment Management Association, JP Morgan, Lipper Financial, Mergent, Inc., Metals Focus Ltd, Moody’s Analytics, Inc., MSCI, Inc., National Bureau of Economic Research, Organisation for Economic Cooperation and Development (OCED), Pensions & Investments Research Center, Qontigo GmbH, Quandl, Refinitiv RP Data Ltd, Rystad Energy, Inc., S&P Global Market Intelligence Inc., Sentix GmbH, Spears & Associates, Inc., State Street Bank and Trust Company, Sustainalytics, Totem Macro, United Nations, US Department of Commerce, Verisk-Maplecroft, Vigeo-Eiris (V.E), Wind Information(HK) Company, Wood Mackenzie Limited, World Bureau of Metal Statistics, World Economic Forum, NBER 2021 (Igor Makarov and Antoinette Schoar), Glassnode, and Coinbase. While we consider information from external sources to be reliable, we do not assume responsibility for its accuracy.

The views expressed herein are solely those of Bridgewater as of the date of this report and are subject to change without notice. Bridgewater may have a significant financial interest in one or more of the positions and/or securities or derivatives discussed. Those responsible for preparing this report receive compensation based upon various factors, including, among other things, the quality of their work and firm revenues.