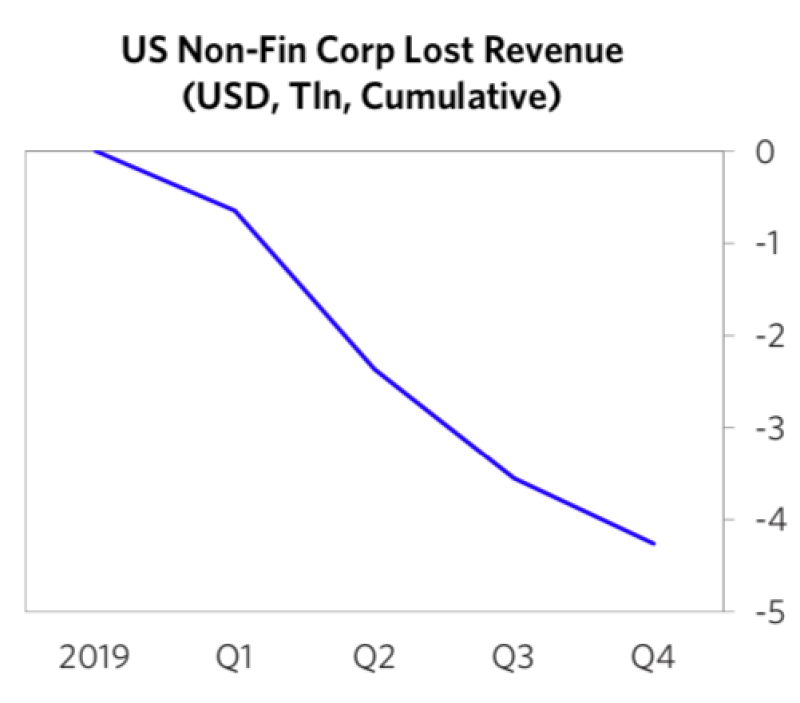

The coronavirus has created a historic decline in cash flows across the globe. Today, we will share our measure of the losses in the US and some thoughts on how the hole can and will be mitigated. At this point, we estimate US corporate revenue across public and private businesses will decline by roughly $4 trillion. That is a very dangerous decline, and, if not mitigated, it will lead to a long-lasting ripple. Since this hit to revenues is happening throughout the world, the total hole globally will be roughly three times that—about $12 trillion. Governments are responding, of course, but in most cases these responses will just mitigate some of the ripple. Governments’ capacities to deal with this hit vary greatly and will be a major driver of markets going forward. Even in the US, which is among the most capable of dealing with this financially due to its reserve currency status, interest rates are rising and gold is falling, reflective of the forced selling of even safe-haven assets to raise cash. In the end, this will spur the Fed to ensure rates don’t rise into a slowing economy, probably leading to wartime-like yield curve targeting. That has to happen fast, as the decline in revenue could cascade. In future research, we will expand to a global perspective and size all monetary and fiscal responses against this hole.

We came to our current estimate for US losses by triangulating three measures. The first interpolates the lost revenue based on the move in equity markets, using a simple discounted cash flow model (assuming half the move is risk premiums). The second uses bottom-up estimates (where corporates or analysts have provided them) and extends them forward using market pricing. The third assumes the hit to revenue by sector in the US is roughly consistent with the by-sector hits we can already see in China. All these methods point to a roughly $4 trillion loss, which, after having poked at these numbers, by and large squares with common sense. It’s consistent with about two months of significant lockdown and a gradual recovery. As with any machine, as the inputs change, so do the outputs. We will continue to update our assumptions and what it means for the size of the hole as we get more information about how the virus plays out.

Without meaningful fiscal or monetary intervention, the $4 trillion figure will mean a decline of over 6% for US GDP this year. We see the most extreme decline occurring in the second quarter, where we expect the level of activity to be more than 10% below 2019 end-of-year levels. Annualized growth numbers, as they are typically reported in the US, may read as bad as -30% in the second quarter (though the timing of calculating and reporting the stats will make a lot of difference). The first thing that will occur is a wipeout of most of the corporate profits and cash on balance sheets. When we go to the sector and company level to convert the revenue shortfall to a cash flow gap, we estimate a shortfall of about $2 trillion, concentrated in energy and travel and leisure, and about equally divided between large and small companies. Many companies will try to fill this gap by drawing credit lines, increasing their debt positions. But If policy responses don’t help fill the gap, we estimate that:

- Companies are likely to cut spending on capex by about $900 billion (4% of GDP), akin to what occurs in material downturns.

- Companies are likely to cut financial spending on stock buybacks and M&A by about $600 billion, or roughly 3% of GDP. This would remove a material support to markets.

- There will also be meaningful cuts in employment as companies cut back on hiring, which will flow through to the economy.

Some companies won’t make it and will default. Market-implied losses are about $850 billion, around a third of which would be borne by banks. This isn’t likely to be a debilitating problem for the financial system or even the banks, given a large capital cushion and plenty of liquidity, but it will put further strains on the financial sector to tighten standards and pull back.

The first charts below size the hit to growth, the hit to revenue, and the capital needs that remain even after the hit wipes out company profits and cash.

Based on triangulating across a range of perspectives, if this hit to spending flows through, we estimate year-on-year growth would come in at a decline of over 6% in 2020. That is worse than what we saw in the financial crisis. Of course, what happens from here will depend on the size of the policy maker response relative to the massive cash shortfall. A GDP decline of this magnitude implies an even bigger decline in business revenues. GDP is a value-added measure, while sales are a gross measure, so in total, sales are nearly twice the size of GDP (e.g. if one fewer car is produced and sold in the US, both the car manufacturer and the steel manufacturer lose revenue).

$4.2 trillion in lost revenue is a staggering amount. For many of the companies taking the hits, it would more than entirely wipe out the cash held on their balance sheets without substantial spending cuts, lenders extending companies new loans, or companies defaulting/restructuring their debts. And while there will be winners (e.g., pharma) and losers (e.g., travel and leisure, resources) within the corporate sector, the big deal is that the lost revenue will be broad-based and many businesses don’t have the cash and profit margins to sustain such a large hit to the top line. This includes many small, unlisted businesses like restaurants, which typically operate at razor-thin margins and are already seeing massive hits to demand. The table below, shows our analysis of the revenue decline by sector of the economy for all companies. For listed companies, our numbers are based on analysis at the level of each individual company, comparing that company’s likely 2020 revenues and expenses against its buffer to withstand shortfalls. Looking across these mismatches, the cash hole adds up to a massive $2 trillion that needs to somehow get filled.

Businesses Can Fill Their Cash Needs with Significant Spending Cuts, but This Will Just Shift the Losses Elsewhere

It’s clear that businesses will have to take drastic steps to fill their cash flow needs. Without policy intervention, a significant portion of these needs will have to be met by spending cuts or defaults on existing debts (in other words, passing the losses to someone else). In the coming days, we’ll separately discuss how we are sizing up the policy response intended to help fill the gap. The charts below give one perspective on what spending cuts might look like. Given financial spending and capital expenditures are usually the first to go, we estimate the cuts needed in both, looking company by company at the gap that needs to be filled. The necessary pullback implies large downstream impacts for growth and equity prices (where corporate spending has been a major support in the past decade).

Firms are also likely to materially reduce spending in other forms, including on labor. Workers paid by the hour in service industries, for instance, are likely to see rapid and automatic hits to income. If corporates need to take more drastic steps like cutting employment, it increases the chances of a self-reinforcing decline in spending.

Credit Markets Are Already Pricing In a Material Loss Cycle, Which Is Likely to Make Banks Less Willing to Extend New Credit

Loss cycles in response to a downturn are part of the economic cycle. To size the implied losses across the major debt markets, we use both the levels and changes in credit spreads and the amount of debt outstanding by player. The change in spreads implies a change in the probability of defaults, which, when applied to debts, gives a rough cut of how expectations for losses have evolved. The table below pencils out these numbers across the US economy, along with mapping the losses to the creditors who are on the hook for them. The losses now priced into US credit markets (roughly $850 billion) are greater than we saw in the 2015 credit cycle but still far short of what we saw going into the financial crisis. The majority of the implied losses are from US corporate bonds and leveraged loans, which have been the largest source of credit this cycle, and these are mostly held by less-levered, real-money players.

These losses are significant, but they are unlikely to put the US financial system at risk. Today, financial leverage is relatively low, balance sheets are not overextended, and banks have fewer asset-liability mismatches and are generally well-capitalized. Zeroing in on the banks, which hold about one third of the implies losses, they can absorb the losses currently priced in with their excess capital, but if the situation worsens and the policy response isn’t adequate, they may need to cut back more meaningfully.

Though the financial system is less likely to crack as it did in 2008, these losses will weigh on lenders willingness to extend new credit. This is because the change in risk/default expectations has left lenders holding more risk of default than they intended before the virus. Their response is logical - pulling back. This response adds to the self-reinforcing nature of a downturn because even healthy lenders with plenty of capital don’t want to make loans that they think will default (e.g., if the borrower is facing a sudden/uncertain income shock). Even though credit growth has been much more muted during this expansion, it could decline materially from here, which would be a significant downward pressure on growth.

This research paper is prepared by and is the property of Bridgewater Associates, LP and is circulated for informational and educational purposes only. There is no consideration given to the specific investment needs, objectives or tolerances of any of the recipients. Additionally, Bridgewater’s actual investment positions may, and often will, vary from its conclusions discussed herein based on any number of factors, such as client investment restrictions, portfolio rebalancing and transactions costs, among others. Recipients should consult their own advisors, including tax advisors, before making any investment decision. This report is not an offer to sell or the solicitation of an offer to buy the securities or other instruments mentioned.

Bridgewater research utilizes data and information from public, private and internal sources, including data from actual Bridgewater trades. Sources include the Australian Bureau of Statistics, Barclays Capital Inc., Bloomberg Finance L.P., CBRE, Inc., CEIC Data Company Ltd., Consensus Economics Inc., Corelogic, Inc., CoStar Realty Information, Inc., CreditSights, Inc., Credit Market Analysis Ltd., Dealogic LLC, DTCC Data Repository (U.S.), LLC, Ecoanalitica, EPFR Global, Eurasia Group Ltd., European Money Markets Institute – EMMI, Factset Research Systems, Inc., The Financial Times Limited, GaveKal Research Ltd., Global Financial Data, Inc., Haver Analytics, Inc., The Investment Funds Institute of Canada, Intercontinental Exchange (ICE), International Energy Agency, Lombard Street Research, Markit Economics Limited, Mergent, Inc., Metals Focus Ltd, Moody’s Analytics, Inc., MSCI, Inc., National Bureau of Economic Research, Organisation for Economic Cooperation and Development, Pensions & Investments Research Center, Renwood Realtytrac, LLC RP Data Ltd, Rystad Energy, Inc., S&P Global Market Intelligence Inc., Sentix Gmbh, Spears & Associates, Inc., State Street Bank and Trust Company, Sun Hung Kai Financial (UK), Refinitiv, Tokyo Stock Exchange, United Nations, US Department of Commerce, Wind Information (Shanghai) Co Ltd, Wood Mackenzie Limited, World Bureau of Metal Statistics, and World Economic Forum. While we consider information from external sources to be reliable, we do not assume responsibility for its accuracy.

The views expressed herein are solely those of Bridgewater as of the date of this report and are subject to change without notice. Bridgewater may have a significant financial interest in one or more of the positions and/or securities or derivatives discussed. Those responsible for preparing this report receive compensation based upon various factors, including, among other things, the quality of their work and firm revenues.