The disruption of Russian energy exports is a shock to the oil market, at a time when demand was already outstripping supply and low inventories. With little room for other producers to ramp up in the short term, demand destruction through higher prices is needed.

Since the Russian invasion of Ukraine, oil has been trading with the ebbs and flows of news about the war and the prospects for peace. It is tough to put a sharp pencil to the outlook for the imbalance between supply and demand with so much in flux. However, our read of the current pressures is that the oil market will remain at risk of acute shortages, even if Russian oil exports come back online, and that continued Russian supply disruptions could require demand destruction for the oil market to balance.

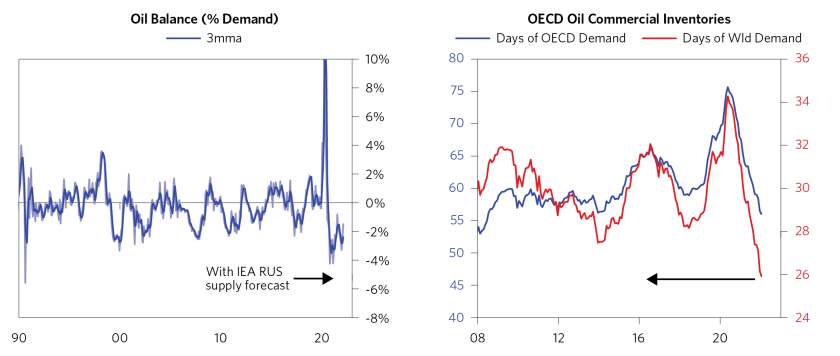

- Before the outbreak of the Russia-Ukraine conflict, global oil demand was outstripping supply by about 2%. We were already expecting a deficit in the market through the middle of 2022 and higher prices. OPEC+ was committed to its pre-existing schedule of production increases, and major US oil producers had vowed to maintain capital discipline even in the face of rising prices—all at the same time the global economy was rapidly recovering and nominal demand was high. As a result, even with Russian oil on the market, shortages were beginning to emerge.

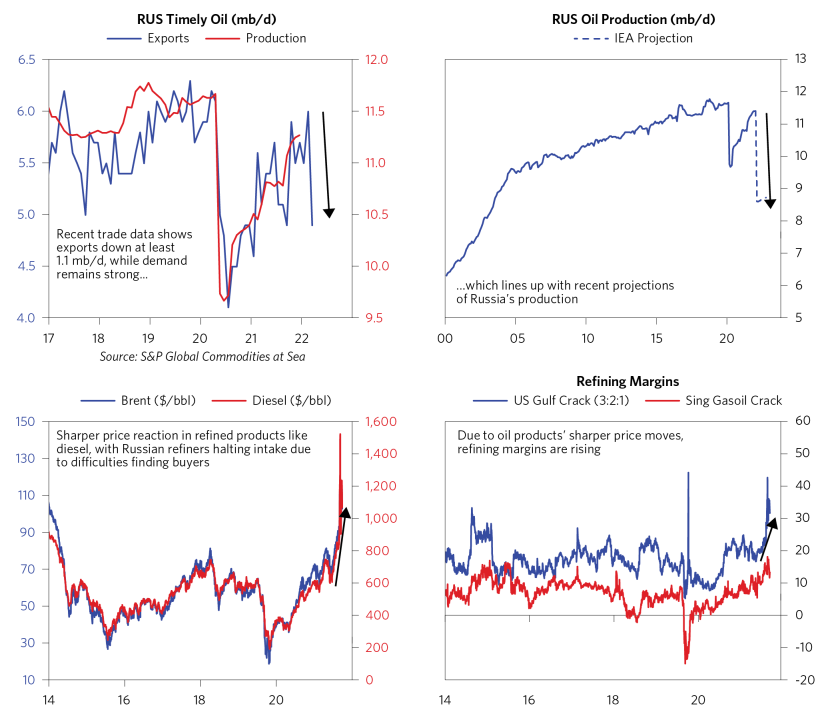

- The effect of the war in Ukraine is to amplify the size of the imbalance and accelerate the timing of when the market has to deal with these imbalances. At this point, a mix of official government sanctions and self-sanctioning by merchants and consumers has caused a 1-2 mb/d disruption in Russian export flows (about 20% of Russian liquid petroleum exports and 1.5% of world supply).

- There is no easy way to replace lost Russian exports, as there are logistical constraints in shipping, ports, and refining capacity. The most immediate problem is refining, as world consumers don’t use crude oil. Russia is not only one of the world’s top three crude oil producers, it is also a major source of refining capacity and a net exporter of finished products. This is why we’ve seen a more immediate reduction to refined product exports and why the most extreme price moves have been in refined products, like diesel. The crude that should be getting processed by Russian refineries is not flowing to export markets as crude but instead going into storage. Whether unrefined barrels go to storage in the short term or the production gets turned off (when storage is full), this constriction of refinery activity in Russia manifests as “less supply” for the global export market. Despite the increase in prices over the past three months, which has been a negative pressure on demand, the scope of the supply shortfall that markets have to address over the next two years has expanded, not declined.

- In the short term, no player is able to fill this supply gap. While US shale is unique in being able to ramp up production very rapidly, even shale producers need at least nine months’ lead time to begin pumping new oil. OPEC+, one of the only players with nominal spare capacity, has little real ability to expand production further than their agreed-upon path to lift quotas. Even those baked-in increases are coming into question, as we consistently see OPEC+ underperform those production quotas. Finally, a US deal with Iran to lift sanctions could offer some relief, but even in a best-case scenario, this is unlikely before late 2022.

- Despite these pressures, oil prices are less than 10% higher than their pre-invasion level. But with all other players able to expand only on a 3+ year time horizon and inventory levels at historic lows, the market is left with only one way to find equilibrium in the near term: a sharp rise in prices leading to demand destruction. Given the sanction measures introduced thus far, which include export controls on the technology, equipment, and Western expertise needed by Russia’s oil industry, we see growing risk that today’s market shortage is expanding in scope and in duration. Rather than an acute problem amplified by a war, circumstances are evolving in a way that the production deficits may become entrenched and endure for a long time.

In the remainder of these reports, we discuss these dynamics in more detail.

The Disruption in Russian Supplies Puts the Oil Market at Risk for the Biggest Deficit in 20 Years

Before Russia’s invasion of Ukraine, global oil demand was outstripping supply by about 2%. Without an immediate downward adjustment to demand, the curtailment of Russian exports elevates this deficit to 3.5%. This is at the low end of what is possible; the International Energy Agency recently forecasted a curtailment of Russian supply that would elevate the supply deficit to 5% of demand, one of the biggest deficits we’ve seen in recent years. And this is occurring at a time when inventories are already extremely tight.

In the Short Term, There Is Little Room for Other Producers to Ramp Up, and Governments Are Actively Tapping Strategic Reserves in an Attempt to Arrest the Rise in Oil Prices…

Every possible source of additional supply is either questionable at best or will take time to come online. Even if supply increases are pledged by producers, it will be months, or years, until those new volumes start flowing.

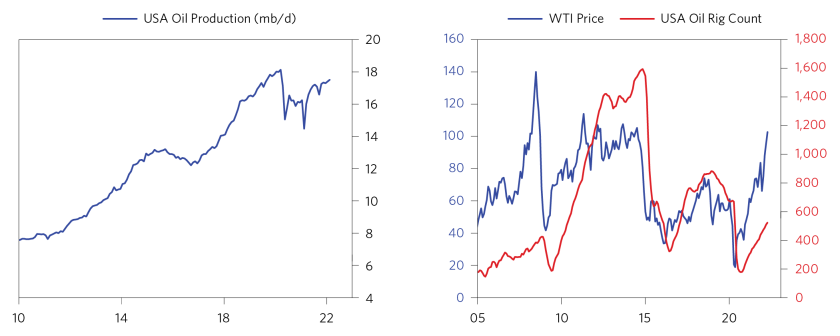

Starting with US shale—as oil prices have rebounded from pandemic lows, development of new oil rigs has been sluggish, resulting in production just barely touching pre-pandemic levels. With US oil producers repeatedly burned by price collapses in 2015 and 2020, investors prioritizing returns to shareholders, and concern around existing and future headwinds from green regulatory measures, it remains unlikely that we will see a return to major production increases in shale. The messaging coming from the companies has remained consistent thus far: they intend to stick to the strict capital budgets for 2022 that were set last year, but this is something that we are continuing to monitor. In fact, we are increasingly concerned that the US administration’s commitment to using the Strategic Petroleum Reserve to tamp down the oil price is working to suppress the risk appetite of the US E&P sector.

OPEC+ is another questionable source of short-term supply. While the core of OPEC+—Saudi Arabia, the UAE, Kuwait, and Iraq—have a theoretical level of spare capacity, they have consistently declined to (or failed to) use it in the past year. There is little indication that this will change in the near term, and no core OPEC+ nation has yet pledged any increase in production quota. Outside of core OPEC+, the picture is even more dire, with production consistently coming in below quota levels in Algeria, Angola, and Nigeria, putting total OPEC+ production well below quota in recent months.

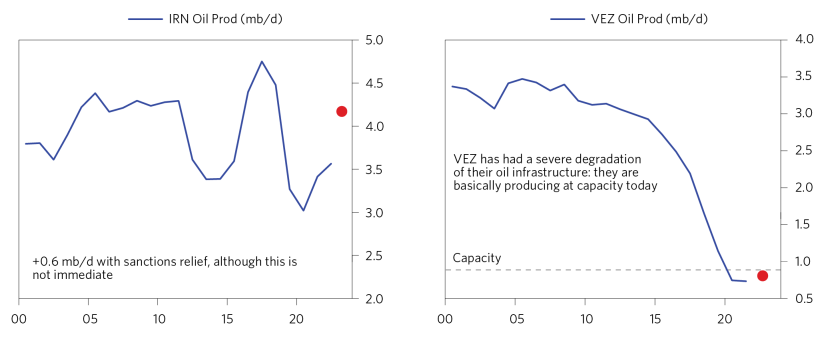

While Iran could bring on +0.6 mb/d to the market over the next year if sanctions were lifted, this increase would take time even if a deal were agreed to today. First, the International Atomic Energy Agency would need to certify Iran’s compliance with the terms of the new deal, which could take between 2-3 months, if not more. From there, the formal diplomatic adoption of the treaty and its implementation could take another 2 months. Only then could oil exports begin, leading to a best-case scenario of more Iranian oil coming online in Q3 of 2022. Even then, Iran alone would not be enough to fill the total loss from Russian oil going offline. Other producers who have been suggested to fill the gap, like Venezuela, are unlikely to be able to do so any time soon. In the case of Venezuela in particular, a massive degradation of oil infrastructure since the US imposition of sanctions in 2015 means that Venezuela is unlikely to be able to provide much oil to the market in the near term.

The one source of new supply markets are receiving right now is a consistent liquidation of Strategic Petroleum Reserves (SPR) by the US government. Since early September, a combination of auctions and inventory swaps means that the US government has become a “supplier” of crude to the market at a rate of 240,000 barrels a day. These barrels are helping to keep private sector inventories from drawing down even faster than they otherwise would. But there is a risk that the medium-term outcome of this tactic is counterproductive. At the same time that the pace of SPR liquidation is too slow to create market equilibrium (by bringing crude supply in line with the pace of demand), it sends a signal to producers that they should not get too comfortable with today’s prices. By wanting to give comfort to consumers, policy makers create unease for producers about what the forward outlook for prices is.

…Leaving Demand Destruction as One of the Only Levers Able to Balance the Oil Market

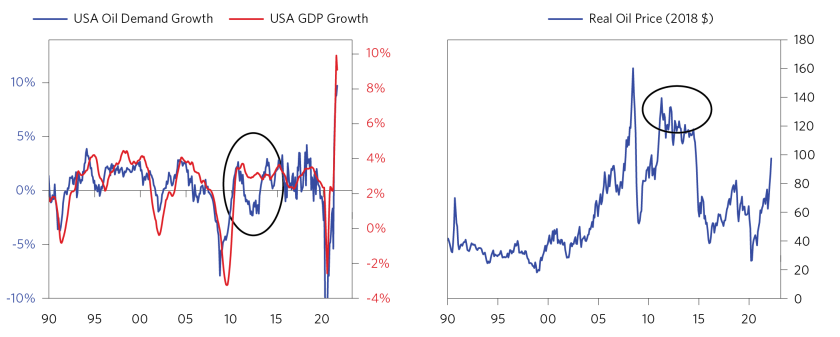

It is hard to know exactly the price at which demand destruction will happen, as it depends on how much demand must be turned off, how long the price lasts, the strength of the underlying economy, and the elasticity of substitution away from oil, among other factors. Previously, we saw some demand destruction in 2011 in the US at $140/bbl, although circumstances have changed radically since then. Our process, which uses the historical relationship between oil prices and oil demand outside of what economic growth would imply, suggests that the required amount of demand destruction could require a spot price upward of $200/bbl.

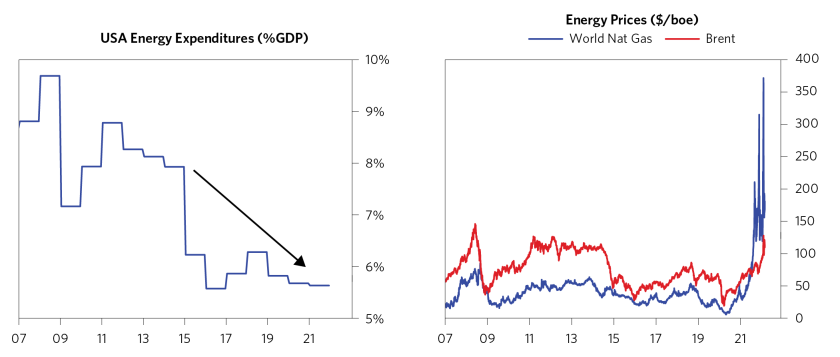

Although that represents a record nominal price, the global economy has become progressively less oil-intensive over time. The current level of pricing is not likely to be a major drag on growth, possibly increasing our ability to sustain high prices for longer. The ability to switch to different sources of fuel has also been hampered—the price of natural gas is radically higher than it was in 2011, when it was able to fill some of the energy needs of end users balking at the price of oil. As shown in the right-hand chart below, natural gas prices are more expensive than oil on a comparative basis:

In real terms, the oil price is not yet near the previous demand destruction level. These factors may mean that we need to see prices above $140/bbl in real terms in order to see demand destruction that will balance the market.

Over the Medium Term, We Will See Bigger Impacts to Russia’s Production Capacity, Meaning There Is a Risk Deficits Are More Persistent

Today, disruptions in Russian oil supply are largely due to difficulties in finding counterparties willing to buy the oil or to provide insurance to the ships to carry it. However, in the medium term, embargoes on Western technology and the flight of Western capital and service providers are likely to leave permanent scars on Russian production.

Russia has built out its domestic service industry since initial sanctions were imposed after the invasion of Crimea in 2014 and can likely keep its existing wells running without Western assistance. But looking past this year, Russia will need to develop new wells to replace the steady decline of existing wells and develop entirely new fields in the north and east of Russia to replace the progressive decline of older fields in the south and west. Both the process of drilling new wells and developing new fields will be hurt by lack of access to Western technology and capital:

- Russia is increasingly running low on reservoirs that can be reached via conventional drilling and will need to turn to fracking and other forms of pressurized drilling to exploit new sources of supply.

- Another important source of new supply is offshore drilling in the Arctic—a complicated exercise done in difficult climatic conditions. These things are hard to do without Western tech.

- This puts an estimated 1.5 million barrels per day of Russian oil at risk just through 2024, with the amount ”at risk” expanding in size the longer sanctions last.

Thus far, we have seen only two producers make a notable adjustment to their investment plans:

- Saudi Aramco is lifting capex in 2022 to $40-50 billion (up from $27 billion in 2020) but is now signaling growing capex to an even higher level from 2023 to the middle of the decade. This will be a helpful source of new supply. But it is important to note that these new increments of oil and gas would come online 2027-30. Despite the work that prices have done over the last three months, the scope of the supply shortfall that markets have to address across the next two years has expanded, not declined.

- Sinopec (China Petroleum & Chemical Corporation) plans its highest capital outlay in history. The 198 billion yuan capital budget for 2022 would surpass the previous record, set in 2013. Also notable is that Sinopec announced on March 25 that it was suspending talks with Russian natural gas producer Novatek for a large petrochemical joint venture.

This research paper is prepared by and is the property of Bridgewater Associates, LP and is circulated for informational and educational purposes only. There is no consideration given to the specific investment needs, objectives or tolerances of any of the recipients. Additionally, Bridgewater's actual investment positions may, and often will, vary from its conclusions discussed herein based on any number of factors, such as client investment restrictions, portfolio rebalancing and transactions costs, among others. Recipients should consult their own advisors, including tax advisors, before making any investment decision. This report is not an offer to sell or the solicitation of an offer to buy the securities or other instruments mentioned.

Bridgewater research utilizes data and information from public, private and internal sources, including data from actual Bridgewater trades. Sources include, the Australian Bureau of Statistics, Bloomberg Finance L.P., Capital Economics, CBRE, Inc., CEIC Data Company Ltd., Clarus Financial Technology, Conference Board of Canada, Consensus Economics Inc., Corelogic, Inc., CoStar Realty Information, Inc., CreditSights, Inc., Credit Market Analysis Ltd., Dealogic LLC, DTCC Data Repository (U.S.), LLC, Ecoanalitica, Energy Aspects, EPFR Global, Eurasia Group Ltd., European Money Markets Institute – EMMI, Evercore, Factset Research Systems, Inc., The Financial Times Limited, GaveKal Research Ltd., Global Financial Data, Inc., Harvard Business Review, Haver Analytics, Inc., The Investment Funds Institute of Canada, ICE Data Derivatives UK Limited, IHS Markit, Impact-Cubed, Institutional Shareholder Services, Informa (EPFR), Investment Company Institute, International Energy Agency (IEA), Investment Management Association, JP Morgan, Lipper Financial, Mergent, Inc., Metals Focus Ltd, Moody’s Analytics, Inc., MSCI, Inc., National Bureau of Economic Research, Organisation for Economic Cooperation and Development (OCED), Pensions & Investments Research Center, Qontigo GmbH, Quandl, Refinitiv RP Data Ltd, Rystad Energy, Inc., S&P Global Market Intelligence Inc., Sentix GmbH, Spears & Associates, Inc., State Street Bank and Trust Company, Sustainalytics, Totem Macro, United Nations, US Department of Commerce, Verisk-Maplecroft, Vigeo-Eiris (V.E), Wind Information(HK) Company, Wood Mackenzie Limited, World Bureau of Metal Statistics, and World Economic Forum. While we consider information from external sources to be reliable, we do not assume responsibility for its accuracy.

The views expressed herein are solely those of Bridgewater as of the date of this report and are subject to change without notice. Bridgewater may have a significant financial interest in one or more of the positions and/or securities or derivatives discussed. Those responsible for preparing this report receive compensation based upon various factors, including, among other things, the quality of their work and firm revenues.