For half a century, Bridgewater has focused on building a deep understanding of global markets and economies to deliver insights for the most sophisticated institutional investors. In this newsletter, our co-CIOs share key themes from this research. Sign up and get access to our latest edition.

After five years of severe imbalances, global economies are converging on a reasonable state of equilibrium — a condition that is generally good for assets. Central banks, including the Fed, are responding to the stabilization of conditions by gradually cutting rates toward what they view as a neutral posture. Growth is running fairly strong, inflation is a touch high but tolerable, and AI technology has advanced to show real potential to enhance productivity over time.

If these were the only developments in the world, you should expect an era of stability and strong profits. This should be a pretty good time to take risk in markets. I say good, not great, because a good outcome is what markets are already discounting. Therefore, exceptional outcomes will be necessary to generate truly great returns.

Enter President-elect Trump and a team of aggressive interventionists. What will their policies be? What will the impacts be? We can assume that the bias will be pro-growth and pro-business, but the uncertainties are high. This political turn of events now fully entrenches a shift in the global world order from free-market globalization to mercantilism.

With the policy backdrop shifting so radically, it’s especially important to pick and choose the assets that are most appropriate given market conditions and your goals, which we believe will be different than the traditional market-cap weighted portfolio for many investors.

Below, I share a piece of our recent research where we translate the macroeconomic pressures discussed above into how we’d allocate capital in 2025. This topic has been at the core of conversations with our global client base, and we hope it is helpful to you as well.

Karen Karniol-Tambour

Co-Chief Investment Officer, Bridgewater Associates

How We Would Allocate Capital in 2025

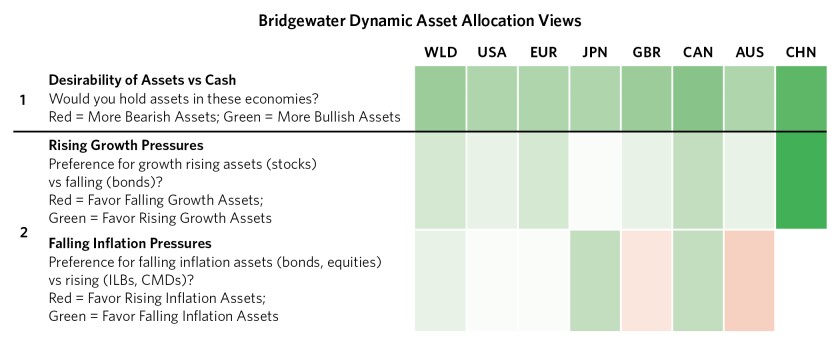

For the first time, we are sharing how we would translate the macro and market pressures we are measuring today into positioning for a dynamic long-only asset allocation. Over the past year, we have developed a systematic approach to doing this at the total portfolio level by examining 1) how attractive it is to own assets and take risk and in which countries, and 2) which assets are most attractive. Looking forward into 2025, at a headline level:

- We expect 2025 to be roughly average (good, but not great) for holding financial assets and taking risk. As discussed above, global economies are converging on equilibrium, a condition which is generally good for financial assets and risk-taking. Central banks are likely to continue easing interest rates, and in the event of a negative shock they will face fewer constraints to easing than we’ve seen in some time. The environment ahead is likely to be good, not great, because asset prices are already pricing in strong outcomes (i.e., risk premiums are relatively compressed), especially in the US.

- We favor spreading risk more evenly than today’s concentrated market-cap weights. A market-cap portfolio is low-cost and efficient to implement, but relative to history it is more concentrated than it has ever been. The world ahead is likely to reward diversification, as increasing global fragmentation in response to rising mercantilist policies will reduce correlations and increase the likelihood that there will be clear winners and losers. In this environment, we think investors can benefit from holding a more balanced portfolio across countries with stable conditions that are priced to ease and are able to do so (the US, the UK, Canada), as well as in countries with substantial easing pressures (e.g., China).

- This environment is likely to favor stocks. We favor stocks in relation to bonds at a comparable level of risk as a strong economy with inflation in check should support corporate profits. The risk, in our view, is that growth continues to surprise to the upside and inflation is stickier than anticipated, supporting profits and leading to pressure to tighten policy relative to what’s currently discounted in bond markets. Within stocks, the US has the highest bar to achieve strong outperformance because priced-in expectations are already elevated—this is also where investors are most concentrated, and we’d favor more diversification. Within fixed income, we continue to think that inflation-linked bonds offer good option value even in a moderate inflation environment given low discounted inflation expectations.

The table below summarizes these views, highlighting the aggregate desirability of assets relative to cash, as well as the relative pressures on assets stemming from the economic environment.

This research paper is prepared by and is the property of Bridgewater Associates, LP and is circulated for informational and educational purposes only. There is no consideration given to the specific investment needs, objectives, or tolerances of any of the recipients. Additionally, Bridgewater's actual investment positions may, and often will, vary from its conclusions discussed herein based on any number of factors, such as client investment restrictions, portfolio rebalancing and transactions costs, among others. Recipients should consult their own advisors, including tax advisors, before making any investment decision. This material is for informational and educational purposes only and is not an offer to sell or the solicitation of an offer to buy the securities or other instruments mentioned. Any such offering will be made pursuant to a definitive offering memorandum. This material does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual investors which are necessary considerations before making any investment decision. Investors should consider whether any advice or recommendation in this research is suitable for their particular circumstances and, where appropriate, seek professional advice, including legal, tax, accounting, investment, or other advice. No discussion with respect to specific companies should be considered a recommendation to purchase or sell any particular investment. The companies discussed should not be taken to represent holdings in any Bridgewater strategy. It should not be assumed that any of the companies discussed were or will be profitable, or that recommendations made in the future will be profitable.

The information provided herein is not intended to provide a sufficient basis on which to make an investment decision and investment decisions should not be based on illustrative information that has inherent limitations. Bridgewater makes no representation that any account will or is likely to achieve returns similar to those shown. The price and value of the investments referred to in this research and the income therefrom may fluctuate. Every investment involves risk and in volatile or uncertain market conditions, significant variations in the value or return on that investment may occur. Investments in hedge funds are complex, speculative and carry a high degree of risk, including the risk of a complete loss of an investor’s entire investment. Past performance is not a guide to future performance, future returns are not guaranteed, and a complete loss of original capital may occur. Certain transactions, including those involving leverage, futures, options, and other derivatives, give rise to substantial risk and are not suitable for all investors. Fluctuations in exchange rates could have material adverse effects on the value or price of, or income derived from, certain investments.

Bridgewater research utilizes data and information from public, private, and internal sources, including data from actual Bridgewater trades. Sources include BCA, Bloomberg Finance L.P., Bond Radar, Candeal, CBRE, Inc., CEIC Data Company Ltd., China Bull Research, Clarus Financial Technology, CLS Processing Solutions, Conference Board of Canada, Consensus Economics Inc., DataYes Inc, DTCC Data Repository, Ecoanalitica, Empirical Research Partners, Entis (Axioma Qontigo Simcorp), EPFR Global, Eurasia Group, Evercore ISI, FactSet Research Systems, Fastmarkets Global Limited, The Financial Times Limited, FINRA, GaveKal Research Ltd., Global Financial Data, GlobalSource Partners, Harvard Business Review, Haver Analytics, Inc., Institutional Shareholder Services (ISS), The Investment Funds Institute of Canada, ICE Derived Data (UK), Investment Company Institute, International Institute of Finance, JP Morgan, JSTA Advisors, LSEG Data and Analytics, MarketAxess, Medley Global Advisors (Energy Aspects Corp), Metals Focus Ltd, MSCI, Inc., National Bureau of Economic Research, Neudata, Organisation for Economic Cooperation and Development, Pensions & Investments Research Center, Pitchbook, Rhodium Group, RP Data, Rubinson Research, Rystad Energy, S&P Global Market Intelligence, Scientific Infra/EDHEC, Sentix GmbH, Shanghai Metals Market, Shanghai Wind Information, Smart Insider Ltd., Sustainalytics, Swaps Monitor, Tradeweb, United Nations, US Department of Commerce, Verisk Maplecroft, Visible Alpha, Wells Bay, Wind Financial Information LLC, With Intelligence, Wood Mackenzie Limited, World Bureau of Metal Statistics, World Economic Forum, and YieldBook. While we consider information from external sources to be reliable, we do not assume responsibility for its accuracy.

This information is not directed at or intended for distribution to or use by any person or entity located in any jurisdiction where such distribution, publication, availability, or use would be contrary to applicable law or regulation, or which would subject Bridgewater to any registration or licensing requirements within such jurisdiction. No part of this material may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without the prior written consent of Bridgewater® Associates, LP.

The views expressed herein are solely those of Bridgewater as of the date of this report and are subject to change without notice. Bridgewater may have a significant financial interest in one or more of the positions and/or securities or derivatives discussed. Those responsible for preparing this report receive compensation based upon various factors, including, among other things, the quality of their work and firm revenues.